Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

A profit and loss statement (P&L), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The P&L statement shows a company’s ability to generate sales, manage expenses, and create profits. It is prepared based on accounting principles that include revenue recognition, matching, and accruals, which makes it different from the cash flow statement.

A company’s statement of profit and loss is portrayed over a period of time, typically a month, quarter, or fiscal year.

The main categories that can be found on the P&L include:

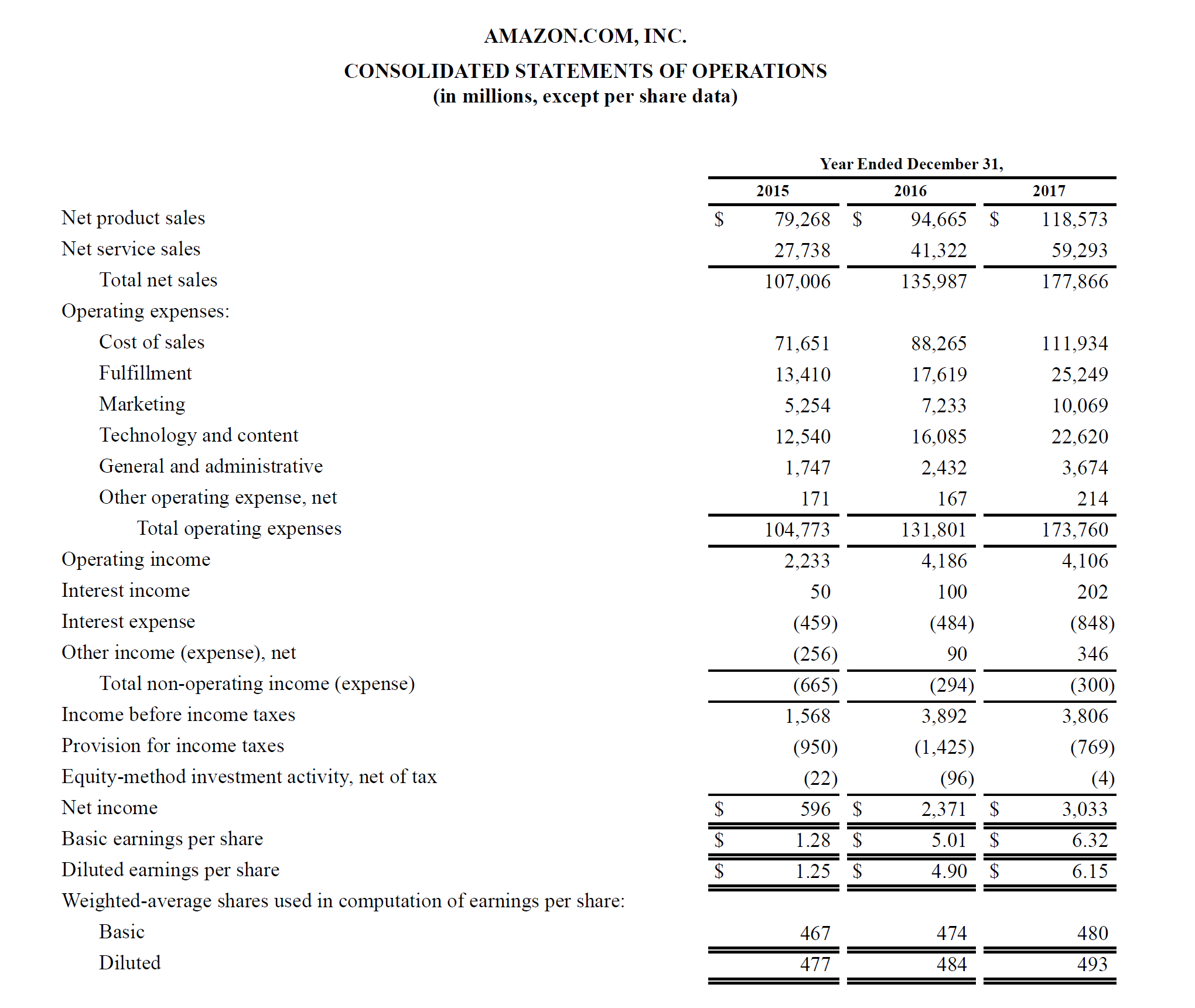

Below is an example of Amazon’s 2015-2017 P&L statement, which they call the Consolidated Statement of Operations. To learn how to analyze these financial statements, check out CFI’s Advanced Financial Modeling Course on Amazon.

Looking at the above example, we see that Amazon posted a profit of $596 million in 2015, a profit of $2.4 billion in 2016, and a profit of $3.0 billion in 2017.

Amazon breaks down its total revenue into product sales and service sales. Its operating expenses consist of cost of sales, fulfillment, marketing, technology, G&A, and others. At this point, it provides a subtotal on the statement for Operating Income, also commonly referred to as Earnings Before Interest and Taxes (EBIT).

Below that, interest expense and taxes are deducted to finally arrive at the net profit or loss for the period. To learn more, read Amazon’s annual report.

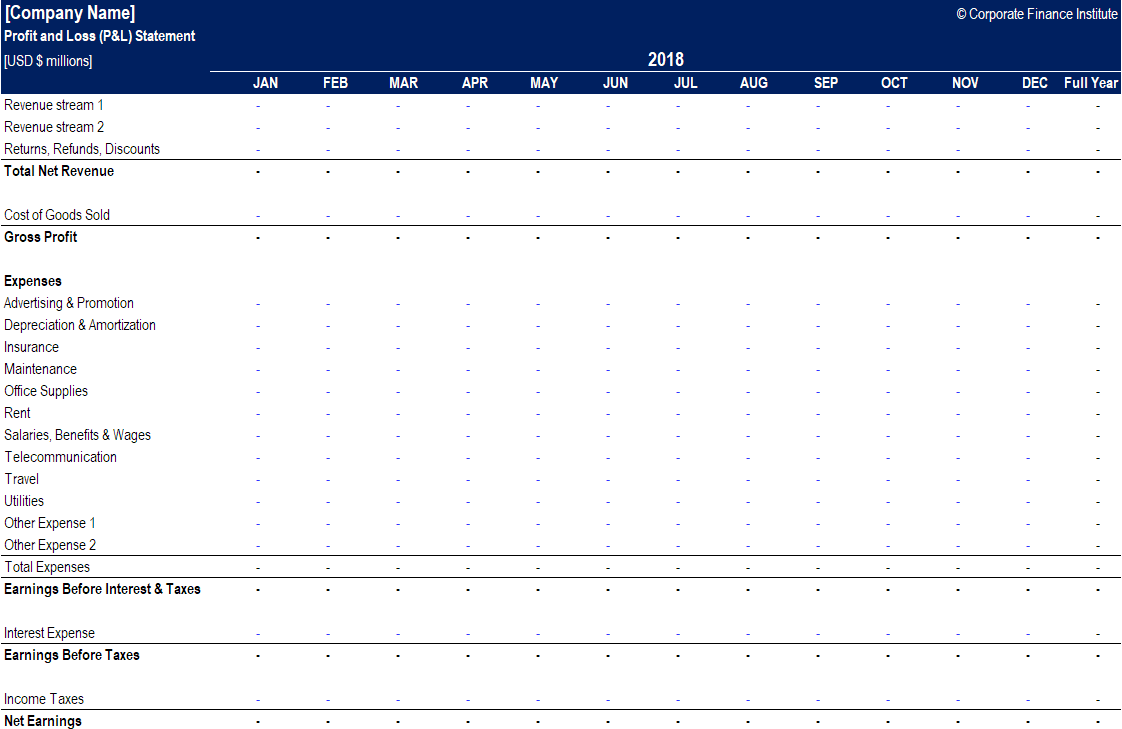

Download the free Excel template now to advance your knowledge of financial modeling.

There are two main categories of accounts for accountants to use when preparing a profit and loss statement.

The table below summarizes these two accounts: income and expenditures.

| Income | Expenditure |

|---|---|

| Revenue | Cost of Goods Sold |

| Sales | Marketing and Advertising |

| Interest Income | Selling, General & Administrative |

| Gains | Salaries, Benefits & Wages |

| Fees Charged | Interest Expense |

| Commissions Earned | Insurance |

| Rental Income | Telecommunication |

| Professional Fees | |

| Taxes |

It might not seem obvious by looking at a profit and loss statement, but the final figure at the bottom (i.e., the total profit or the total loss) may be very different from the actual amount of cash that’s made or lost.

The main factors that create a difference between profit and cash generation are:

Analysts must go beyond the profit and loss statement to get a full picture of a company’s financial health. To properly assess a business, it’s critical to also look at the balance sheet and the cash flow statement.

The balance sheet shows a company’s assets, liabilities, and equity at a specific point in time. This snapshot of the company’s financial position is important for assessing:

The statement of cash flow shows how much cash a company generated and consumed over a period of time. It consists of three parts: cash from operations, cash used in investing, and cash from financing. This statement is important for assessing:

One of the main jobs of a professional financial analyst is to analyze the P&L of a company in order to make recommendations about the financial strength of the company, attractiveness of investing in it, or acquiring the entire business.

Examples of P&L statement analysis include:

Below is a video explanation of how the profit and loss statement (income statement) works, the main components of the statement, and why it matters so much to investors and company management teams.

Thank you for reading CFI’s guide to understanding the profit and loss statement. CFI is on a mission to help you advance your career. With that goal in mind, these additional CFI resources will be very helpful:

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.